Russian production of valves and accessories in 2008 -Figures and facts, analytical review

Both the total production volume by Russian valves plants and the production volumes of the basic valves types it is being reviewed in the given case.

In addition, we purchase and analyze the export-import transactions database of the Federal Customs Service. Published reports are based on the primary sources (the data from manufacturers about valves production volumes), and secondary sources (the statistical information from Federal State Statistics Service (ROSSTAT), the data of the Central Bank of the Russian Federation, the reports of independent experts published in mass-media, and several other sources).

Structure of production

This section will offer a review of basic trends on the market in 2008 according to the questionnaires received from the valves manufacturers, the data of quarterly accounts of open joint-stock companies, and the data of Goskomstat (Russian State Statistics Committee). In spite of the fact that the first half of the year was rather successful for domestic producers, the total annual production volume decreased by 4,5 % in natural terms, and growth (in robles) made up 13 % in terms of value on the results of 2008 versus 2007. This may be explained by price rises on products. In a dollar equivalent growth made up 16 % .

For more detailed analysis we considered the data, received from the 57 biggest manufacturers of pipeline valve and accessories. The total production volume of these manufacturers was $820 million USD and 19440000 items of pipeline valve and accessories. Analyzing the received information it may be concluded that the leaders in production volume in terms of value are steel gate valves and ball valves having just about the same production volume. There are followed by electric actuators, steel globe valves and iron gate valves. The smallest percentage is accounted for by steel valves and check valves.

Steel valves (check valves) were the leaders of growth in terms of value last year, followed by steel globe valves and steel ball valves. The production volume of the iron gate valve and globe valves made from cupriferous alloys was reduced. The steel ball valves showed the highest growth rate in natural terms.

Emerson will supply 780 Fisher digital control valves for a project at the Saudi Kayan petrochemical complex -including a DN 1050 Fisher antisurge valve - the largest ever built

Structure of imported pipeline valves and accessories in Russia

The valves import volume increased by 62% in terms of value and by 11,8% in natural terms in comparison with 2007. The leaders in import volume are the ball and plug valves, the gate valves are the second, followed by import of sanitary valves. Control valves and globe valves are the fourth and fifth in the rating. In natural terms the ball valves, plug valves and gate valves are mostly imported.

Valves and accessories were imported to Russia in 2008 from 93 countries.

Distribution by regions is given in Figure 1. The majority of valves and accessories were imported from European countries, or $907 million USD (73,4%). Valves and accessories from CIS countries amounted to $95,9 million USD (7,8%). Due to the increasing of Chinese imports the total import from Asian countries increased by 21% and made up $180,7 million USD. Import volume from American countries made up $46,3 million USD. Import from Africa and Australia is negligible (0,09% and 0,04%).

Export structure

In 2008 the export volume of valves from Russia exceeded the same figures of 2007 by 11,7%, in natural terms the growth by 3,7%.

Gate valves and ball and plug valves have nearly equal parts of total export volume (20,2% and 20,4% respectively), then followed globe valves (11,6%) and other accessories (11,4%). Least, as well as last year, it is taken out diaphragm valves (0,2%) and sanitary valves (2,6%).

In 2008 the highest growth was shown by ball valves and plug valves, their deliveries increased 150% from 2007. This position in 2008 was first having outproceed the gate valves that were leaders during several years. The delivery growth of check valves made up 44,9%,

spare parts 33,9%, sanitary valves 24%, gate valves 12,3%, the delivery growth of other accessories, safety and diaphragm valves made up 10%, 9,8% and 8,8% respectively. The delivers volumes of globe valves were reduced by 14,2%, control valves by 7,4%, butterfly valves by 23%, pressure reducer valves by 21,7%.

Russia exports valves to 108 countries among them 5 countries with consumption volume more than $10 million USD for 2008 make 70,5 % from total annual consumption.

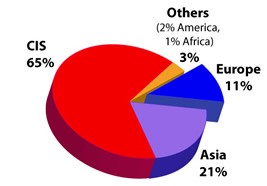

Most valves are exported to CIS countries (see fig.2). For 2008 the export to these countries made up $184,72 million USD (65% of total export volume). Valves delivered to Asian countries made up $58,5 million USD (21%), to European countries $31,7 million USD (11%). Export to America, Africa and Australia is negligible

(3 % totally).

Market of pipeline valves

Summing up, it may be said, that the foreign trade surplus made up for the negative peak over the last 10 years. It was a result of the considerable increase of imports in 2008. Table 1 gives the main indices of the valves market. We compared volumes in 2007 and 2008 at an average course for 2008 to show the trends which are independent from the exchange difference.

In 2008 as well as in previous years the majority of export deliveries were accounted for by CIS countries. We analysed the delivery volume every month in 2007 and 2008 to define whether reduction of delivery volume is connected with an economic crisis. The analysis results show that the deliveries were reduced sharply in the fourth quarter and remained at the level of about 240 thousand US dollars a month. It is possible to assume that this reduction actually is connected with an economic crisis, and since October that production was delivered only on earlier annual contracts which had been concluded.

Material of this review is a part of a report made by Executive direction of Scientific Industrial Valve Manufacturers Association (NPAA). The report allows us to formulate a perception of the current market situation in the sector of pipeline valves and accessories in Russia and to forecast development using available trends.

The following reference materials were used during market review:

. Database of customs declarations from the Main Research & Information Computer Centre under the Federal Customs Service of Russia;

. Results of statistical processing of data received by NPAA from manufacturers;

. Quarterly and annual reports of manufacturers;

. Information from specialised publications.

NPAA, Tel: 00 7812 5287571

Email: npaa@npa-arm.org

Published: %dth %B %Y

Rachel Wormald, Managing Director at YPS Valves Ltd and Elizabeth Waterman, ...

Are you looking for industry-leading, brand independent valve and actuator ...

As can be seen from the photograph, clearly the resident birds at Bartlett ...

Howco Group has unveiled its latest £1million investment, with the ...

In 2024, Allvalves is poised for an exciting year of growth and expansion, ...

GMM Pfaudler Engineered Plastics & Gaskets are delighted to bring the ...

In the ever-evolving valve industry, GMM Pfaudler stands out for its ...

SAMSON Controls Ltd – part of the SAMSON group - a renowned leader in ...