View from the Other Side

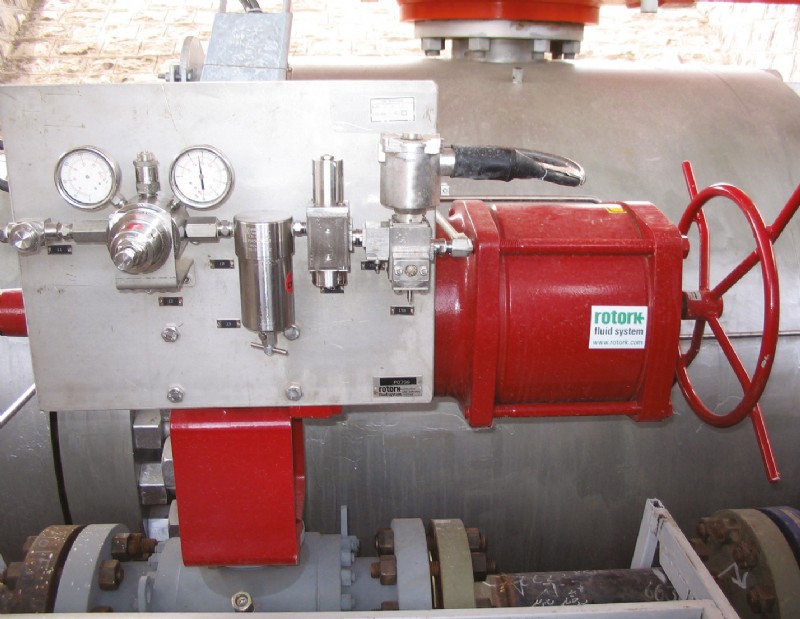

Photograph courtesy of Rotork Fluid Systems

Pneumatic actuator accessories in the US oil industry

The continuing weakness in the price of oil has had a significant impact in the US oil industry. At first, improvements in the operational efficiency of the many production companies engaged in the shale oil boom contributed to their survival even with $40 per barrel oil. But as oil prices remain soft the strain is showing.

The oil and gas support industries have also been forced to look hard at their operations and trim overhead and costs where possible. Of particular interest to the valve and actuator supply industry is the pressure on distributors to reduce inventory overhead.

Specifically, some major distributors are looking at the complexity and variety of accessories needed to support sales of pneumatic actuators for the oil and gas industries.

Most large distribution companies in Houston for example, are either global themselves, or supply global customers. This necessitates an inventory capable of satisfying not only the domestic US market, but also the various demands of the global market.

There are significant differences between the inventory required to supply electric actuators and that needed to supply pneumatic actuators.

Electric actuators are mostly selfcontained, with integral motor starters, switches and controls all prewired in a hazardous area certified enclosure. Many electric actuators are also supplied with manual override devices as standard. For domestic applications this reduces the inventory variables to the size and speed of the actuator output, voltage and certification being fairly standard for the USA.

Pneumatic actuators, particularly large types, have a much greater range of options to be satisfied. The traditional method of supplying a pneumatic actuator is to take the basic prime mover, a scotch yoke, rack and pinion or other type of actuator, and attach control accessories as required by the application and the customer’s preference. This means that the switches, solenoid direction control valves (DCV), tube and fittings may all be different for each individual customer, even though the general application may be the same.

The fact that these components are “bolt on” devices leads customers to select their preferences for standardization on site. In contrast, electric actuators enclose all the control components inside the actuator housing and so they are out of sight. This allows electric actuator manufacturers to standardize on their internal components as an integral part of the device. The result is that procurement specifications do not mandate the details of these internals.

On the other hand, pneumatic actuator procurement specifications often call out a specific brand of solenoid DCV, position switch and sometimes even the tubing and fittings. This gives the typical oil and gas industry stocking distributor has a difficult task when trying to rationalize and streamline their inventory of pneumatic actuator accessories.

This does not impact other industries in quite the same way. Pneumatically automated valves used in general industrial applications are often much smaller, allowing the smaller pneumatic actuators to use standardized mountings and accessories. The NAMUR standard, for example, grew from the German The following companies have joined BVAA since the last issue of Valve User Magazine: BVAA New Members chemical industry and has migrated to other industries that use the smaller pneumatically automated valves. However, these standards do not scale up to the larger actuators that are commonly used in the oil and gas upstream and midstream applications.

Because of the size and variation in shape of the larger pneumatic actuators it is very difficult to standardize on integrated, internal air supply lines as is done on smaller rack and pinion actuators, for example.

There is a degree of sophistication that has been achieved with electric actuators in terms of torque or thrust output sensing, non-intrusive set up and diagnostics that is not as common in pneumatic actuators. In theory all of these functions could be achieved on pneumatic actuators and the smart positioners used in process control modulating applications provide these functions to a degree. But this leaves the majority of large pneumatic isolating applications without a complete solution.

There are some combination switch and solenoid DCV assemblies available and some even have digital communications capability for field bus systems. They can be supplied with one of a variety of hazardous area certifications and so this would seem to be a concept that, potentially, could satisfy the simplification requirements of the suppliers to the oil and gas industry.

The challenge for the manufacturers of these products is obtaining the approval of the global customers that like to have their preferred solenoid DCVs and position switch brands.

There should be an opportunity for an effective design that can incorporate the required functions of a solenoid DCV, position indicating switches, nonintrusive set up, diagnostics and digital field bus communications in a robust enclosure that meets the hazardous area requirements.

This would require solving the problems that occur when different solenoid voltages, DCV functions, switch capabilities and certification requirements have to be accommodated within the design. Such a device should go some way to solve the current inventory problems of the distributors.

| Telephone: | 01295 221270 |

| Email: | enquiry@bvaa.org.uk |

| Website: | www.bvaa.org.uk |

| More information on the British Valve and Actuator Association BVAA Member Directory Page |

Search related valve / actuator articles: British Valve and Actuator AssociationIssue 36Market Reports

-web.jpg)