European Recession to Continue

Rise in annual UK Industrial Production is poised to persist into mid-2015 before tumbling in the latter half of the year. Expect a weak global economic environment to be the main culprit, but decline is likely to remain brief and mild. Weak exports to North America are contributing to slower growth in the economy. Annual UK Exports to Mexico are down 12.0% from last year; Exports to the US are down 4.1% over the same period; and Exports to Canada are down 9.8%. Expect North America to demand fewer imports from the UK this year due to slower regional economic growth.

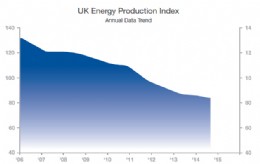

The UK is an energy importer. In fact, nearly 14.0% of total imports are tied to petroleum. Falling Oil Prices should benefit companies operating in the UK, but electricity companies are keeping rates high despite the drop in wholesale prices. Persistantly high energy prices are weighing on UK Energy Production, down 3.0% from last year on an annual basis. While energy prices are falling for most of Europe, rising energy costs in the UK could deter investment into heavily energy-dependent industries.

Use this period of stagnant economic activity to prepare for the upturn expected to take hold from 2016 to 2018. Beware of linear budgets and review capital expenditures with an eye toward decreasing expenses for 2015. Conduct a thorough review of established people, products, and procedures and eliminate the ones that are not contributing to your bottom line. Research niche markets that will be outperforming the overall European economy and target your efforts in those segments to mitigate the loss associated with economic downturn.

ITR Economics International is able to help your company see tomorrow’s economy today. Confidence about your markets over the next few years will help you lead your business while providing you with a tool to outperform the competition. For additional information on how ITR Economics International can give you a greater planning tool to assist in meeting your business needs or to suggest future article topics, please email jackie@itreconomics.com.

| Telephone: | 01295 221270 |

| Email: | enquiry@bvaa.org.uk |

| Website: | www.bvaa.org.uk |

| More information on the British Valve and Actuator Association BVAA Member Directory Page |

Search related valve / actuator articles: British Valve and Actuator AssociationIssue 32BVAA NewsMarket Reports

-web.jpg)